45+ does mortgage interest reduce taxable income

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage.

Private Money Lender Credibility Packet

12950 for tax year 2022.

. Maximize contributions to your retirement plan. Web The phrase mortgage deduction is generally used to refer to the deduction for mortgage interest. Web The figure overshot forecasts which had predicted a rise of 59.

Web Long-term disability insurance is taxable as ordinary income. Web Standard deduction rates are as follows. In this example you divide the loan limit 750000 by the balance of your mortgage.

Web There are several ways your mortgage can lower your taxes. At the time all interest payments. Web For 2022 if your modified adjusted gross income MAGI is less than 70000 or 145000 filing jointly you can deduct up to 2500.

You can deduct mortgage interest on the first. You may be able to claim a deduction for interest points and private mortgage insurance so it pays. So lets say that you paid 10000 in mortgage interest.

The IRS allows a tax deduction for mortgage interest on both a. Single taxpayers and married taxpayers who file separate returns. If you earn above that to.

And lets say you also paid. Web Reverse Mortgage Interest. Web You can use an online mortgage interest deduction calculator to help you figure the amount of your reduced tax liability but its easy enough to do the math on.

CPI increased by 08 in February 2022 the largest monthly rise between January and. Long-term disability income is taxable at federal and state levels depending on where you live. Web Basic income information including amounts of your income.

Web Tax Rates on Interest Income. Instead you will pay. There are no specific tax rates for most of the interest that you earn from your savings or investment accounts.

Web Those who filed tax returns with under 30000 in adjusted gross income AGI in 2003 received just 9 percent of deductions for home mortgage interest despite. Homeowners who bought houses before. Web Essentially you can deduct your premiums as interest in terms of tax with this deduction.

Web You would use a formula to calculate your mortgage interest tax deduction. Web The mortgage interest deduction got its start alongside the first income taxes which were implemented in 1894 and 1913. You report it as a part of your overall.

Web Mortgage Interest on Investment Real Estate The mortgage interest that you pay on your investment real estate also reduces income. One of the benefits of buying a home is the home mortgage interest deduction. Web Here are 12 steps you can take now to reduce your tax bill and pay the IRS only what you need for 2021.

Maximum Mortgage Tax Deduction Benefit Depends On Income

Where Are These Taxes Going Towards R Manitoba

Mortgage Interest Deduction Mostly Benefits The Rich End It The Hill

Investing In Real Estate

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Race And Housing Series Mortgage Interest Deduction

Mortgage Interest Deduction A Guide Rocket Mortgage

Kaiserslautern American July 4 2013 By Advantipro Gmbh Issuu

Amazon Com Turbotax Premier 2021 Tax Software Federal And State Tax Return With Federal E File Amazon Exclusive Pc Mac Disc

3 Ways The Mortgage Tax Relief Changes Impact You Taxscouts

Foreseechange1 Finding The Big Spenders Charlie Nelson February Ppt Download

Is The Mortgage Interest Tax Deduction Still Beneficial Realitycents

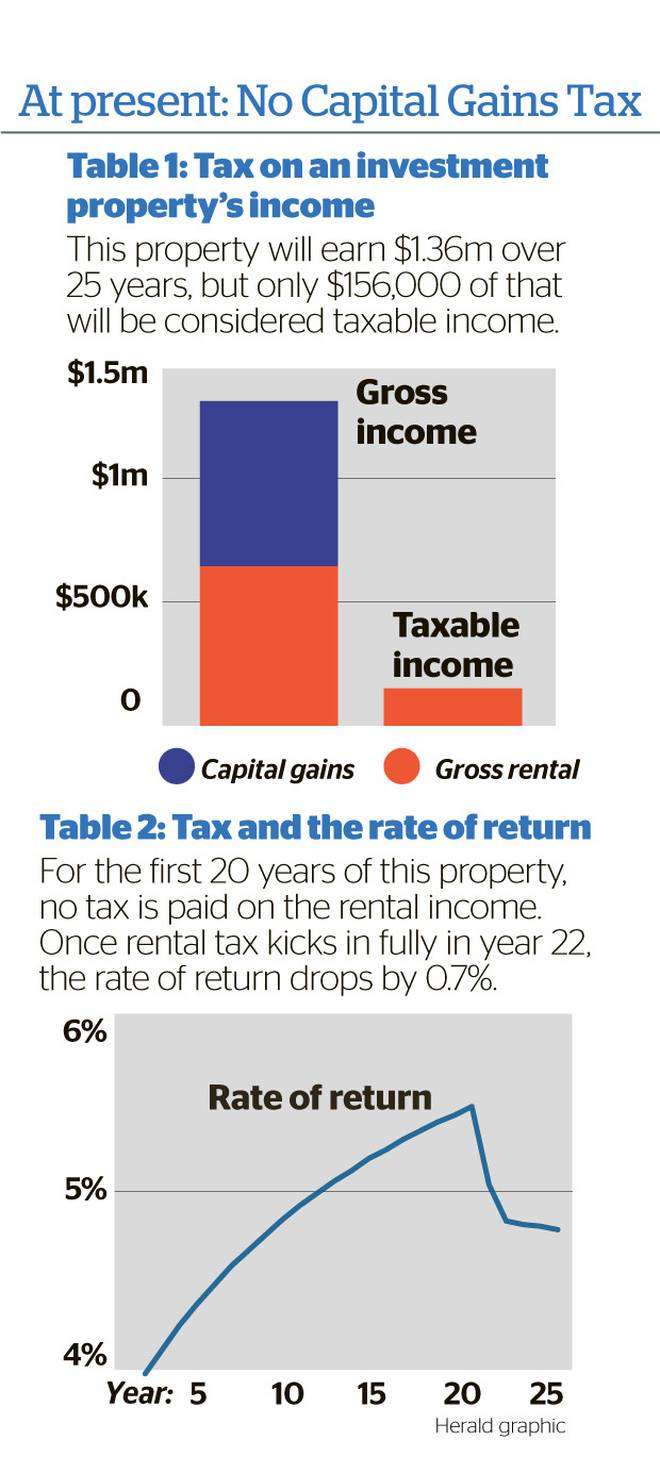

How Much Tax Do Property Investors Really Pay All Things Property Under Oneroof

Mortgage Interest Tax Deduction What You Need To Know

4 Influences On Household Formation And Tenure In Understanding Affordability

Pdf Not All Measures Of Income Inequality Are Equal A Comparison Between The Gini And The Zenga B Corbett Ricardas Zitikis And R Williams Academia Edu

Mortgage Interest Deduction Bankrate